594-Friday Q&A: If I Have No Credit Score (Because I Haven't Borrowed in >25 Years) Should I Start Building It?

It's Friday! That means it's Q&A time. Today we cover:

- If I have no credit (because I haven't borrowed money in >25 years) should I work on building my credit score?

- What has traveling like for Joshua and what are his plans for Radical Personal Finance.

Joshua

- If you'd like to be on next week's Q&A call, sign up here: www.radicalpersonalfinance.com/patron

593-Lifestyles of the Frugal and Obscure

The Lifestyles of the Rich and Famous might make good TV but it's the Lifestyles of the Frugal and Obscure that makes for wealthy people who keep their money.

Joshua

- If you're interested in learning how to borrow money safely and never paying interest with credit cards, go buy my new course! www.radicalpersonalfinance.com/creditcardcourse

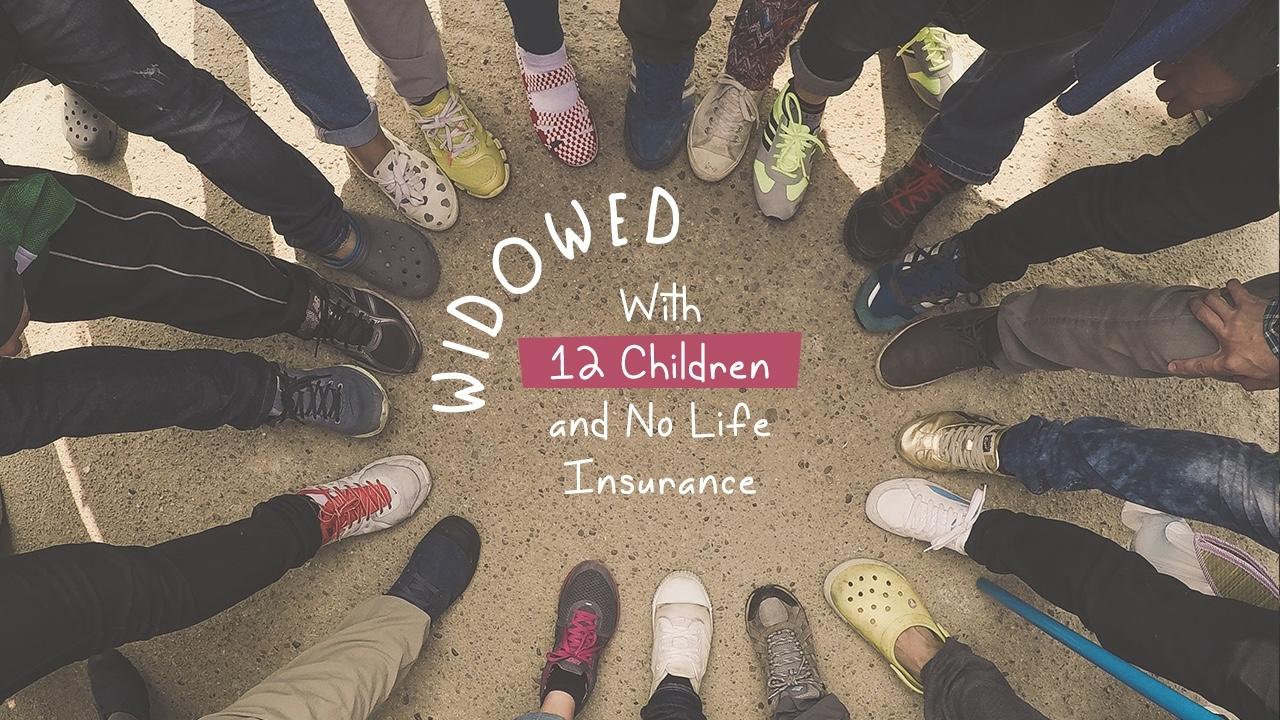

592-Widowed With 12 Children and No Life Insurance! One Woman's Story.

What do you think would happen to a mother of 12 who was widowed at a fairly young age and whose husband didn't have any life insurance? Could she survive? If so, how?

Today, I want to share with you the story of a friend of mine who went through that precise circumstance. I hope you enjoy it!

Joshua

591-Friday Q&A (Credit Card Edition): New Cards, Refinancing Mortgages, and Credit Freezes

Today we tackle:

- How do I get new credit cards when I've already maxed out my limits?

- Should I refinance my mortgage over onto my credit cards so I can drop Private Mortgage Insurance?

- How should I handle a credit freeze on my accounts?

Remember, go buy the credit card course this weekend. It's at www.radicalpersonalfinance.com/creditcardcourse and you can save $10 with promo code CREDITCARDTEN.

Joshua

590-Who Should Never Have a Credit Card?

There are people who should never, ever, have a credit card. And of course they shouldn't buy my new course "How to Borrow Money Safely and Never Pay Interest Using Credit Cards."

But, everyone else should buy it. Go here: www.radicalpersonalfinance.com/creditcardcourse

Save $10 with promo code: CREDITCARDTEN

Joshua

589-How to Manage Cash While You Pay Off Your Credit Cards

Credit cards can be really useful. But contrary to popular opinion, they're not the most useful when you're broke. They're more useful when you have a little cash.

Enjoy this excerpt from my new course "How to Borrow Money Safely and Never Pay Interest Using Credit Cards."

And then go buy it here: www.radicalpersonalfinance.com/creditcardcourse

Use "CREDITCARDTEN" to save $10. Until Monday only.

Joshua

588-Credit Card Loans Can Provide a Way to Privately Purchase Goods and Services

One of the most under-appreciated aspects of credit cards is the significant privacy they can afford you. Listen to the show for details.

Remember, please sign up for my new credit card course: www.radicalpersonalfinance.com/creditcardcourse

Use coupon code "CREDITCARDTEN" to save $10 off the price. (Good until 10/15/18.)

Thank you!

Joshua

587-Credit Card Debt Is a Very Safe Form of Debt

One of the most useful aspects of credit cards is how safe the debt is when compared to other forms of debt. Enjoy this excerpt from my brand new course called "How to Borrow Money Safely and Never Pay Interest Using Credit Cards."

The course is now available for you to buy. Go here: www.radicalpersonalfinance.com/creditcardcourse

Use the coupon code "CREDITCARDTEN" to save $10 off the price. (Valid until 10/15/18.)

Thank you!

Joshua

586-Friday Q&A (Credit Card Edition): Should I Close My Old Credit Cards Before Applying for a Mortgage, How Should I Refinance my Business Credit Card, How Can I Use My Credit Cards Privately, How Do I Pay Off My Credit Card Debt as a Newlywed

Today, we do a special (and really good) live Q&A exclusively on the topic of credit cards. We cover:

- Should I Close My Old Credit Cards Before Applying for a Mortgage?

- How Should I Refinance my Business Credit Card?

- How Can I Use My Credit Cards Privately?

- How Do I Pay Off My Credit Card Debt as a Newlywed?