617-Friday Q&A: Giving Money to Poor People, Contributing My Salary to my Wife's 401(k), Protecting Investment Accounts, Buying Term Life Insurance while FI, etc!

1:45 - How can I give nice gift to people who are poorer than I am without creating a power imbalance?

15:20 - Can I contribute my salary into a 401(k) plan for my wife in order to maximize our retirement account contributions?

28:05 - How can I protect my non-qualified investment accounts that are exposed to the claims of creditors?

44:30 - I don't "need" term life insurance because I'm financially independent. Should I still buy some?

51:00 - I'm following Dave Ramsey's baby steps and am almost out of debt; should I store up my emergency fund in a Roth IRA?

56:00 - I want to buy an investment that will pay for my new car instead of just burning all my cash on the car. How do I do that?

(For the context of any time-relevant comments relating to current events, this Q&A was recorded on 12/19/2018.)

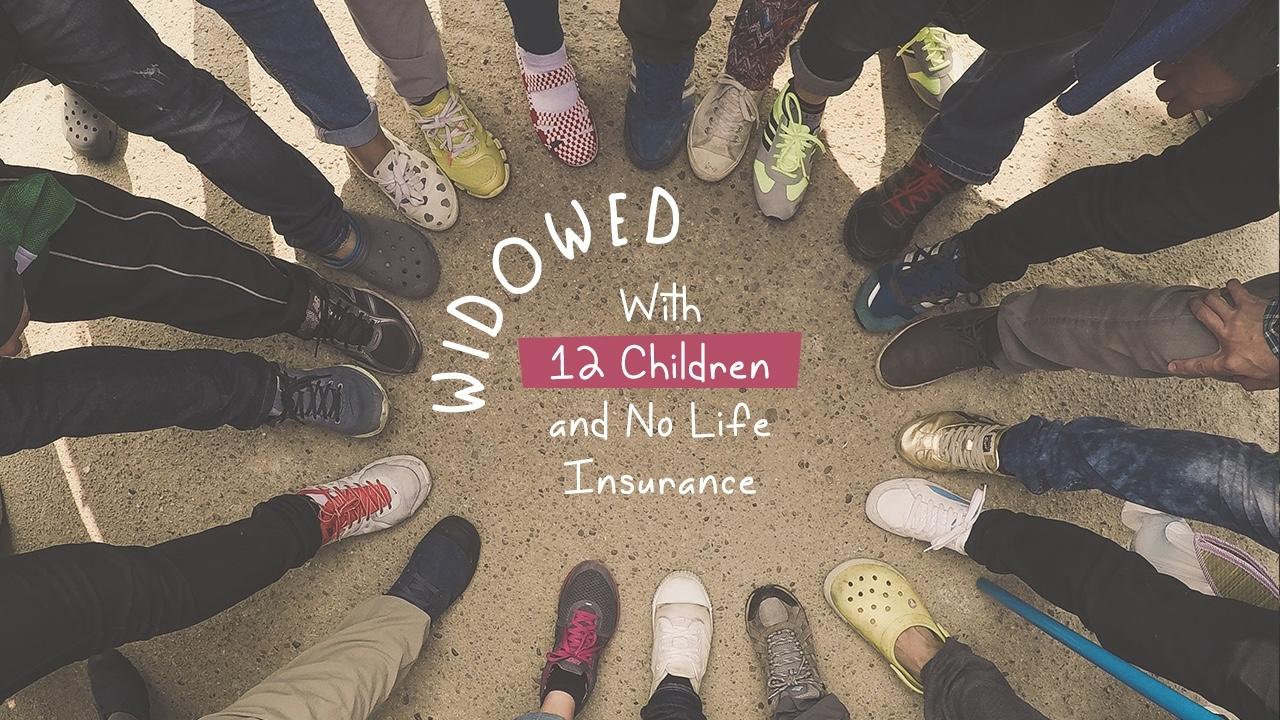

592-Widowed With 12 Children and No Life Insurance! One Woman's Story.

What do you think would happen to a mother of 12 who was widowed at a fairly young age and whose husband didn't have any life insurance? Could she survive? If so, how?

Today, I want to share with you the story of a friend of mine who went through that precise circumstance. I hope you enjoy it!

Joshua

541-How to Protect Your Family From Your Death When You Can't Qualify For Life Insurance

I recently worked with a consulting client who had this problem: because of a previous (serious) cancer diagnosis, he is unable to qualify for life insurance. How can he protect his family in case he dies soon?

I thought it a really interesting challenge. And since I've thought a lot about this particular problem, I thought I'd go ahead and share my thoughts with you.

Enjoy!

Joshua

- Please support RPF on Patreon: www.radicalpersonalfinance.com/patron

- Episode 204: High Risk Life Insurance Underwriting

- Art Robinson's story

531-Friday Q&A: How to Establish a Will & Trust While Living Internationally, How to Title Life Insurance Policies for Spousal Protection

It's Friday! That means Q&A! Today, we cover:

- How to establish a will and trust when you plan to be living internationally for an extended period of time.

- How to plan ahead to pay for kids' college when you anticipate that the college may lose its accreditation.

- How to properly title your life insurance policies in order to protect a vulnerable spouse.

529-Friday Q&A: How to Protect From Disability Without Disability Insurance, How to Cover Unknown Future Risk, How Should I Finance a Land Purchase, Will My Credit Score Be Messed Up By Mortgage Shopping, How to Adjust Content for Different Audiences

Friday Q&A today! We cover:

- How can I protect myself from the risk of disability without getting disability insurance?

- How can I make sure that future, unknown risks are adequately covered today?

- What financing option should I use to buy a piece of land?

- Will my credit score be messed up by shopping for a mortgage?

- How can I adjust content for different audiences?

I'd love to have you call in next week! Details here: www.RadicalPersonalFinance.com/patron

Joshua